If you're a high-income borrower with federal student loans, you've probably looked into Income-Based Repayment (IBR) and wondered: Should I pay down part of my balance before enrolling?

This post walks through a real-world scenario where a borrower considers making a $60,000 lump sum payment before switching to IBR, with the goal of minimizing the total cost of repayment using a time value of money framework.

Background

The borrower:

The idea: Make a $60,000 lump sum payment before switching to IBR. Why? Because under IBR, there's a built-in cap: your monthly payment will never exceed what you'd pay on the 10-year Standard Repayment Plan at the time you enroll. That means paying down your loan before enrolling in IBR locks in a lower cap.

Does Paying Down Before IBR Help?

Yes—and here's why it matters:

If you expect to hit the cap due to high income, this prepayment can result in massive savings.

IBR Comparison: With vs. Without Lump Sum Prepayment

Let’s assume SAVE is no longer an option. You’re choosing between:

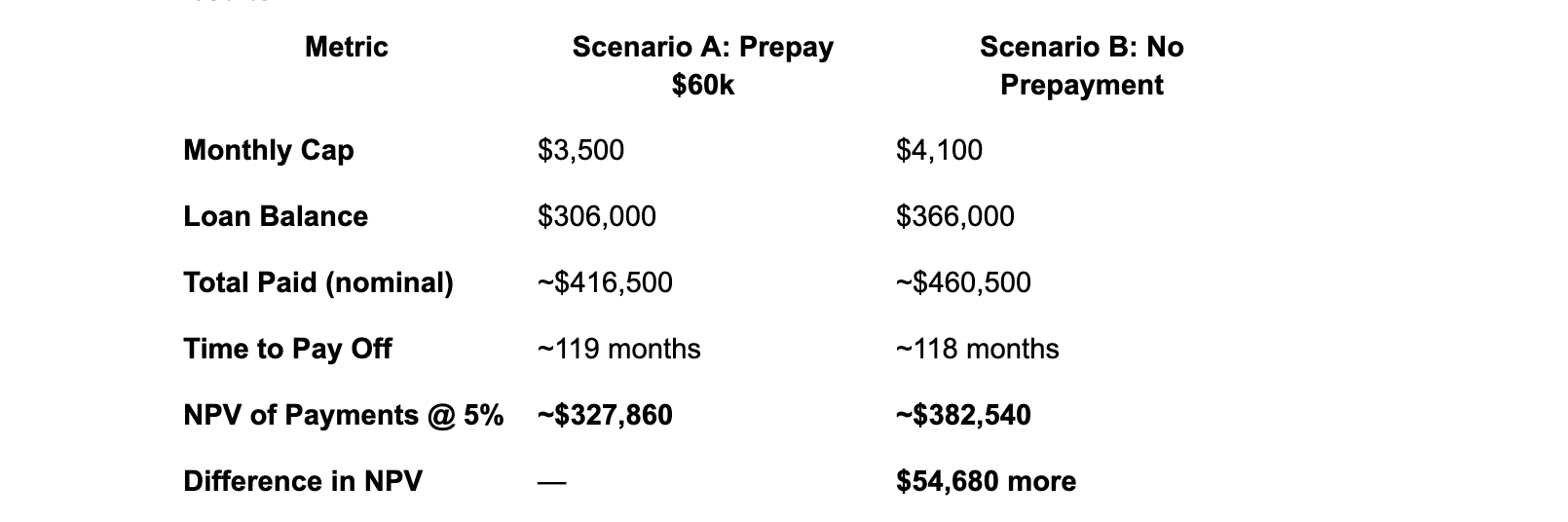

We used a 5% discount rate to evaluate the net present value (NPV) of each strategy. These projections assume full repayment under IBR and do not rely on forgiveness. Although you've already completed 6 years of qualifying time toward forgiveness, this comparison assumes you will pay the loan off completely under IBR rather than waiting for forgiveness at year 25.

Results:

Interpretation:

Final Thoughts

If you're a high-income borrower with:

…then making a strategic prepayment before switching to IBR may be your best financial move.

It locks in a lower cap, reduces long-term interest cost, and helps you avoid relying on uncertain forgiveness policies.

Disclaimer: This content is for informational and educational purposes only and does not constitute legal, financial, or tax advice. While care has been taken to ensure accuracy, neither the author nor the firm assumes any liability for errors, omissions, or outcomes resulting from reliance on this information. Readers should consult with a qualified financial advisor or tax professional before making decisions related to student loan repayment strategies.